Tour: Cash Flow

Cash Flow looks like accounting, but is actually closer to scheduling. Cash Flow is concerned only with liquid income and outgo.

Later the Why do businesses fail? section of the Why Use Sumer? page discusses the importance of controlling cash flow.

Problems with cash flow are the second most common cause of failure for start-up businesses. And yet it is rare to find cash flow solutions in business packages. For any business that may already be experiencing cash flow problems it is hard to justify putting out an additional costs to purchase a cash flow module or stand-alone app.

That is why Sumer includes an easy-to-use cash flow solution as a basic tool that should be available to every business.

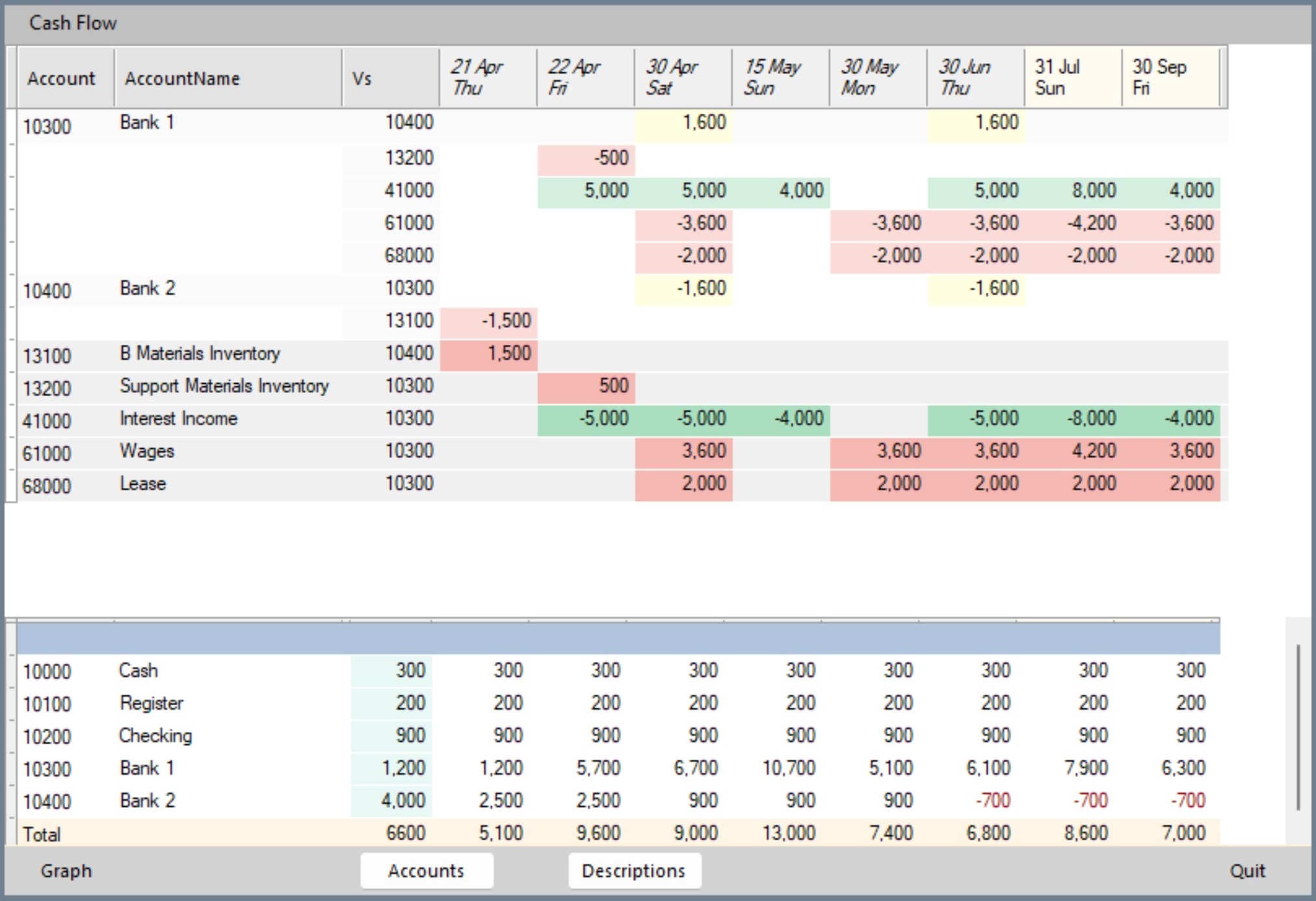

In the Cash Flow worksheet the upper panel is divided into liquid assets like Cash and Banks in white, and income or outgo in grey.

Green entries represent cash flowing into the business, pink entries represent cash flowing out, and yellow entries represent transfers between liquid accounts.

As with the Schedule forms presented earlier, entries can be dragged to new dates—the debit and credit pairs move together—or duplicated with Ctrl-drag.

The lower panel represents liquid account balances.

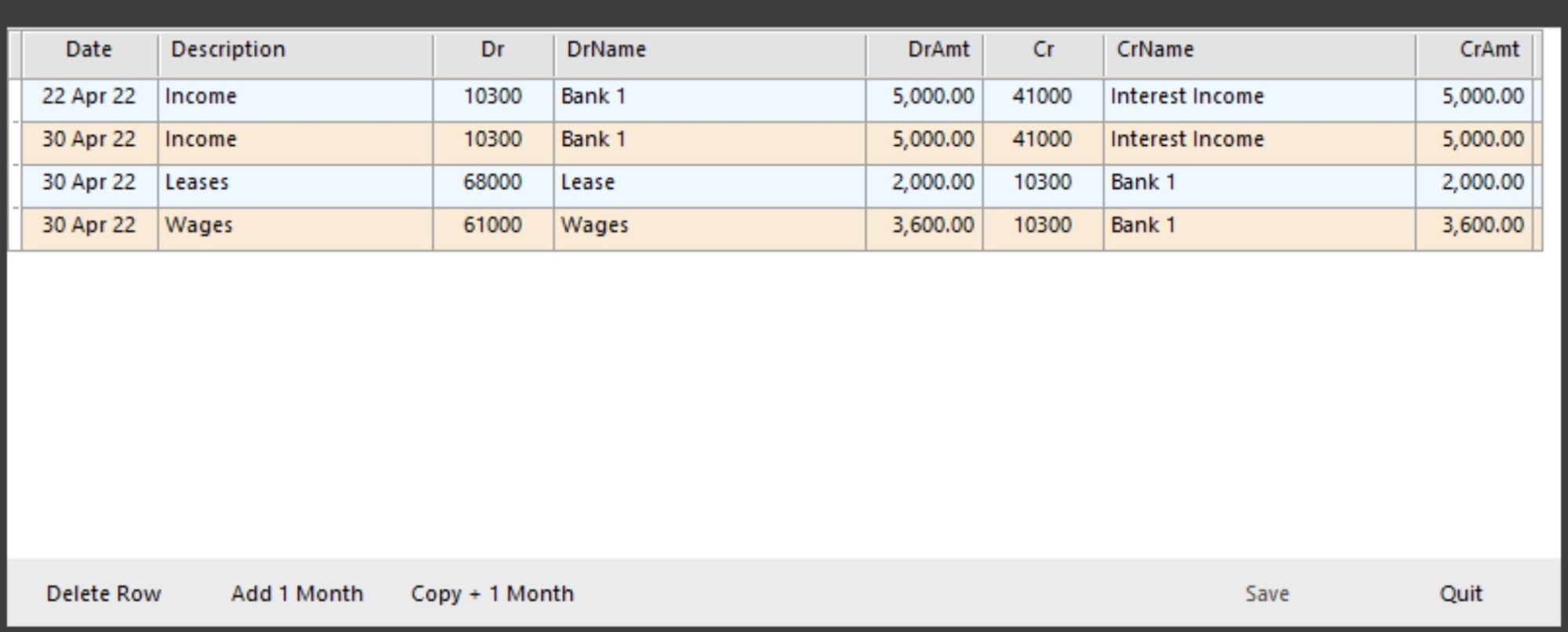

Double-click in the upper panel opens the Entry form for editing.

Buttons allow moving or copying the entire Entry to future months.

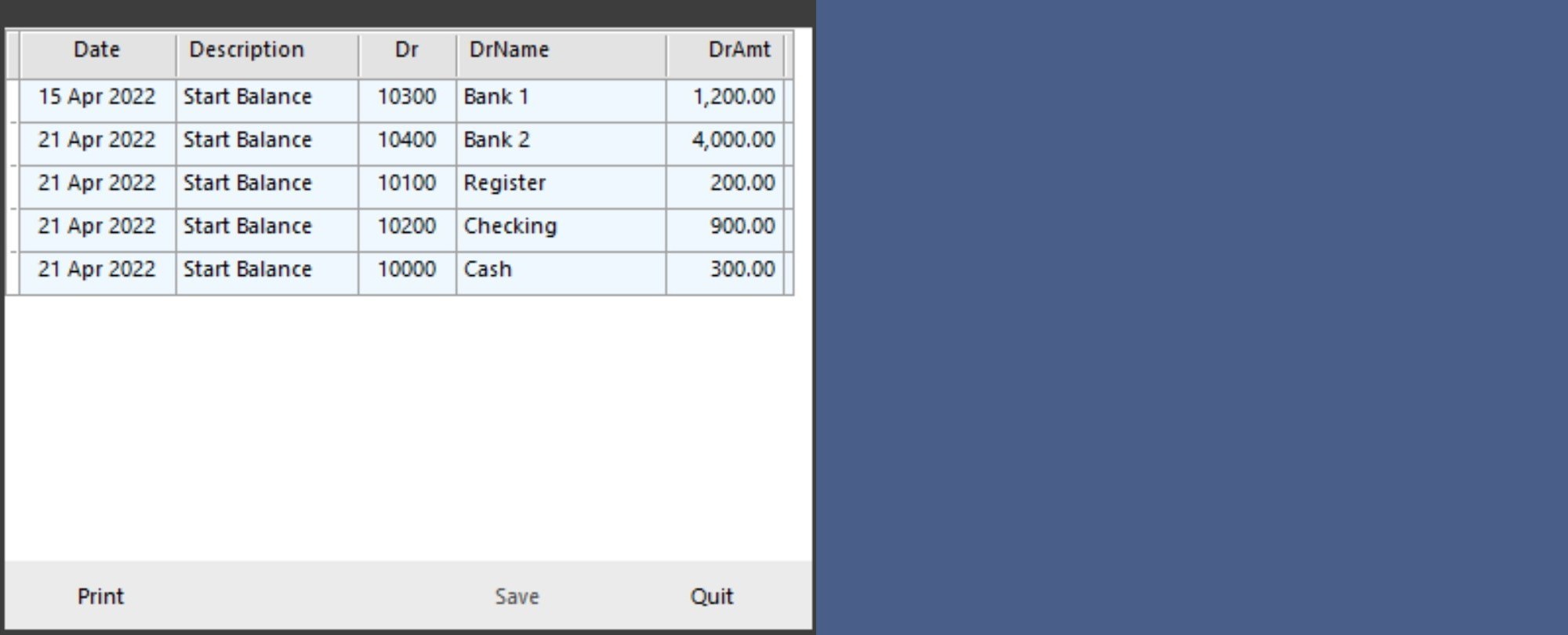

Double-click in the lower panel opens the Start Balances for editing.